Nethra Sailesh, Pune

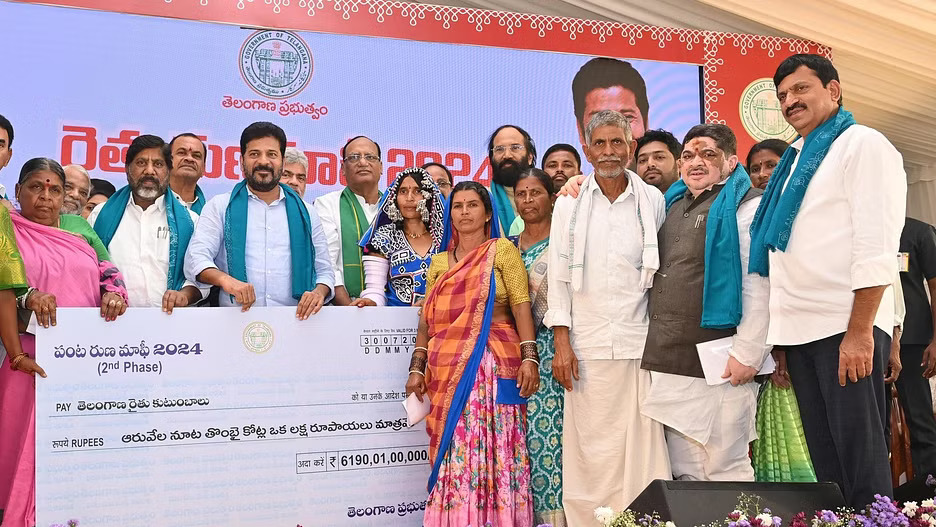

On Tuesday, Telangana Chief Minister A. Revanth Reddy announced the start of the second phase of the crop loan waiver scheme. In this phase, a total of Rs 6,190 crores will be given to over 5 lakh farmers to acquit them of their credit.

The Crop Loan Waiver Scheme was introduced in 2018 to help farmers with their agricultural loans and alleviate their financial burden. The scheme’s first phase was launched on July 18, 2024, where Rs 1 lakh was directly deposited in the accounts of farmers who have taken loans from commercial and cooperative banks. A dedicated portal to apply and check eligibility for the same has been established. To identify the beneficiaries of the scheme, Public Distribution System data will be used.

The CM also mentioned that loans up to 2 lakhs are set to be waived off in August. He attested that despite having difficulties with mobilizing funds, the government is committed to freeing farmers from debt.

As reported by the Deccan Chronicle, farmers have expressed their happiness over the commencement of the second phase of the scheme and the improvements that have come with it. This response follows the technical issues faced during the first phase, which delayed the process.

The entire scheme will take place in 3 phases. The final phase which is set to begin by mid August, will consist of waiving loans up to 2 lakhs. The government is set to spend a total of Rs 31,000 crores across all phases.

In the state, more than 60% of the population is dependent on agriculture. This contributes to 15.8% of the Gross State Domestic Product. The CM emphasized that July and August would become important months to commemorate this loan waiver. The allocation of funds under the scheme has set a new record in Indian history.

However, the first phase of this scheme was met with complaints. As reported by the Hindu Business Line, certain categories of loans by those under self-help groups or joint liability groups as well as restructured loans have not been added to the scheme. Nonetheless, the scheme’s long-term impact is yet to be seen.