Eeshna Dashottar, Pune

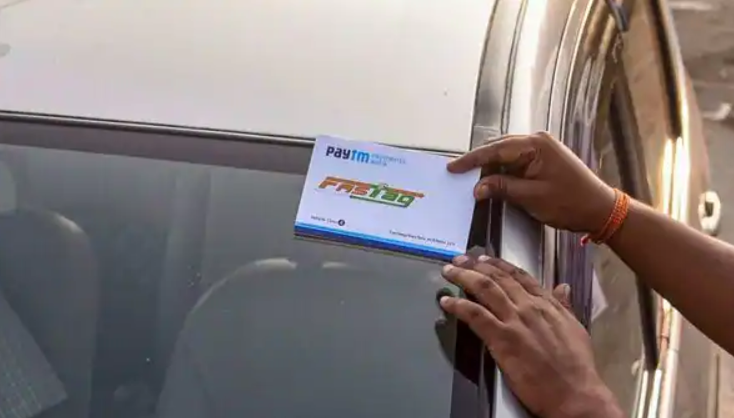

The National Highways Authority of India (NHAI) has provided further updates on its ‘One Vehicle, One FASTag’ initiative, as a potential extension in the compliance deadline for the same has been announced. The deadline has now been shifted to March-end. This update has been made as Paytm FASTag users are experiencing issues with the service. Initially, this initiative was planned to come into action on March 1, 2024, with February 29 as the deadline.

An official told the Press Trust of India that because of the Paytm-related issues that have come to light recently, FASTag users are likely to be given more time to make changes as per the updated FASTag norm as per the initiative. The initiative aims to sort out the confusion created by the usage of a single FASTag for multiple vehicles as well as linking multiple FASTags to a single vehicle. The initiative intends to enhance the electronic toll collection system and bring efficiency to hassle-free movement at toll plazas.

Recently, the Reserve Bank of India (RBI) brought the issues related to Paytm Payments Bank Limited (PPBL) to the notice of the customers and merchants using the services of PPBL. RBI also asked the company to stop any further transactions, deposits, and top-ups on customer accounts after February 29, 2024. The users were instructed by the RBI to move their accounts to other banks by March 15, 2024. As per RBI, customers could continue to make use of FASTags for the payment of tolls up to the available balance. However, further top-ups of FASTags done through Paytm Payments Bank would not be permitted to users after March 15, 2024. Due to these non-functionality concerns, the extension of the deadline comes as a respite for the public as they get time to make further arrangements.

Furthermore, the nodal body has asked the users to finish the ‘Know Your Customer’ process at the earliest for their FASTag to function in compliance with the guidelines from the central bank. If the users fail to do so, the FASTag will be deactivated or blacklisted by financial institutions for further use.